Stewardship.

Teamwork. Family.

Our Team Delivers Personalized Solutions for Complex Problems.

We believe that financial planning should be so much more than just offering a cookie cutter retirement and collecting as many clients as you can. Everything we do for our clients is based on our shared beliefs in our duty as financial stewards, the collaborative effort of teamwork, and the importance of treating your co-workers and clients like your family.

Our Approach

Wealth accumulators, retirees, business owners, and executives all have varying degrees of financial needs. Oftentimes, busyness or confusion get in the way of achieving financial success.

The reality is that you don’t have to walk this path alone. You can have a trusted advisor that knows your situation and helps plan for life’s challenges.

Our comprehensive and personal planning process takes a critical look at your situation from a tax, investment, estate and risk management perspective. We connect and communicate your needs to our network of professionals, ensuring your best interests are held paramount. Our goal is to help you save on taxes, enjoy your ideal retirement, and live a life of generosity and purpose.

Raymond James nor its advisors provide tax or legal advice.

Our Office

Our office is our second home, and we want you to feel just as comfortable here as we do. Have a seat. Grab a snack or a drink and tell us how your day is going so far. What’s the latest with your family? How is your dog?

Kids and grandkids are always welcome here. Let them enjoy one of our toy baskets and a capri sun while they sit in the meeting with you, or your older children might enjoy relaxing on the couch for a bit or working on their homework in the conference room. (Many members of our team would be overjoyed if your well-behaved dog wanted to come with you as well).

Our Company

As an independent financial firm, we have no products to sell you, no minimums we need to hit each week. Our only goal is to be the best stewards of your finances that we possibly can be. We will always go above and beyond what is expected of us and provide the highest level of service.

As the local branch of a large company, we can offer you the best of both worlds. Here in Knoxville, we can provide the client focused approach of a small firm where everyone is happy to help and you will never get lost in a maze of hallways or wonder which floor you are supposed to be on.

Behind us we have the resources and knowledge of two powerhouses in SageSpring Wealth Partners and Raymond James, two companies that both believe in the importance of helping you reach financial independence, so you can focus on what’s important—personally, professionally, and spiritually.

Our parent company, SageSpring Wealth Partners, was established in 2002 as an independent organization and oversees more than $5.5 billion in client assets as of November 2021. SageSpring is comprised of more than 60 advisors who care for more than 13,000 clients across the country, with offices in Tennessee, Alabama, Texas, Iowa, and Nebraska.

Raymond James is our broker-dealer, meaning they hold our clients’ assets and provide support to our firm with reporting, statements, trading platform, investment analysis, and other various financial planning technology and resources. Raymond James was started in 1962 and currently has approximately $1.26 trillion in client assets under management.

Raymond James nor its advisors provide tax or legal advice.

Why I Became a Financial Advisor

When I walked into my first financial office, I didn’t expect it to change my whole life. Mostly because all I was thinking at the time was that it smelled like mothballs. I’ll never forget that smell as I walked into that shadowed brown-leather lobby. As I was ushered past the dark mahogany receptionist’s desk littered with notes and stacks of paper, I felt a pit in my stomach. You know what I’m talking about…that “one of these things does not belong—and it might be me” type of feelings. That feeling did not improve once in the advisor’s office. As I listened to the older gentleman in the three-piece suit spout off terms like “probate” and “defensive strategies”, I sunk lower in my seat. “What the heck is he talking about?”, I thought to myself. “Am I allowed to ask? Should I raise my hand, or just play along like I know what he is talking about?”

No, this wasn’t my defense attorney prepping and lecturing me on my upcoming trial appearance. This was my local financial advisor. As a newly minted 21-year-old, I was taking ownership of an investment account established for me as a child, and I had been told to come to this office to do so.

When he was done talking at me the well-intentioned advisor successfully filled out the paperwork for me, and I numbly scratched my “John Hancock” on it. I left that one-sided conversation feeling small and more confused than ever. “What am I investing in again? The trades cost how much? And what exactly is a risk tolerance?” I muttered as I left the office and walked back out into the now blinding sunshine.

“Oh well,” I mumbled as I got in my car and fumbled the key into the car’s ignition. “I guess this is how financial stuff works”.

And then it happened. As my car engine roared to life, so did this question—WHY? Why does it have to be this way?! Why does it all have to be so confusing? Why should we accept being left in financial darkness as the status quo?

Why can’t advisors condense complex ideas into simple action items? Why aren’t they prioritizing listening over talking, teaching over lecturing? Or what if they focused on serving over selling? Whether you’re 21, 51, or 81 you deserve the knowledge and the confidence to understand your finances. And I am sure we can all agree that investing in relationships has equal if not greater value than picking the investments in a portfolio…

That is the reason why I started Cullman Wealth Team. I will never forget the feeling I had in that office. I never want to feel that way again, and I don’t want anyone else to either.

In this complex, confusing world, you deserve a trusted guide who delivers clear financial advice and works beside you to cut through the noise

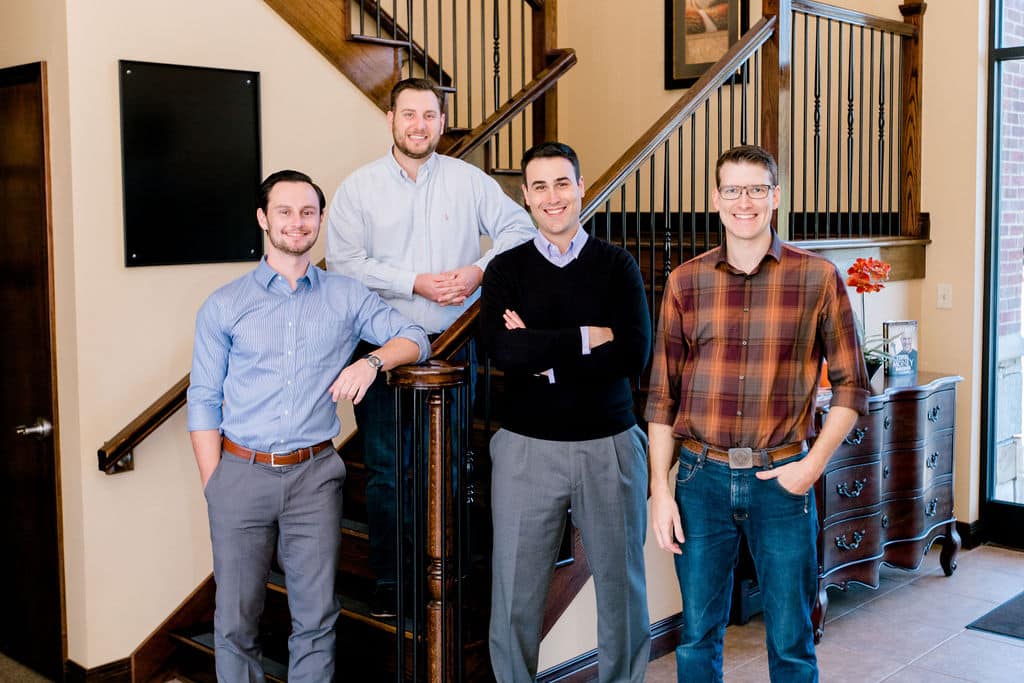

Meet Our Team

Learn more about each of the dedicated members of the Travis Cullman Wealth Team.

Travis Cullman

CFP®, CPFA

Senior Vice President, SageSpring | Financial Planner, RJFS

Matt DeGraff

CFP®

Financial Associate, SageSpring | Financial Professional, RJFS

Connect with Us

SageSpring is invested in more than just your finances. We are invested in you.

Connect with us today, and discover how our unique, holistic approach to financial planning can guide you to long-lasting peace and prosperity.

"*" indicates required fields

Our Location

136 Concord Road

Knoxville, TN 37934

Recent Insights

How to Know If You’re a Good Candidate for a Financial Advisor

Have you ever wondered what it might be like to work with a financial advisor? Maybe you’ve been working on building your financial portfolio for a few years and you’re ready to take the next

Are Exchange-Traded Funds a Good Investment?

Exchange-traded funds (ETFs) and mutual funds are excellent options to diversify your investment portfolio. However, not everyone is aware of the difference between the two or how each option works. In this blog, we will

Essential Tax Deductions Every Small Business Owner Should Know

If you’re a small business owner, you know just how hard it is to keep your head above water while managing a business—especially during tax season. As a small business owner, you want to make

What is the Safe Withdrawal Rate in Retirement?

They don’t call it the golden years for nothing! Retirement can be one of the most rewarding seasons of life—especially if you’ve prepared for it. It’s the time of life that you get to focus