By Mark Deering, CFP®

Since my son, Caleb, was four years old, he’s been saving up to buy a Jeep. As parents, it’s always encouraging to see your children set long-term goals for themselves, as many people – especially children – don’t have the patience for long-term anything. It’s been even more encouraging for Rachel and I to see Caleb stay on top of his goal for more than 10 years. That’s not to say he didn’t seek our advice along the way, but ultimately we left everything up to him.

About 5 years ago, Caleb approached me with a question about Hot Wheels. Yes, the little toy cars that many people collect, and many others buy cheap and sell to make a potential profit.

“Why am I investing in mutual funds when I could buy Hot Wheels and sell them for a quicker return?” he asked.

Instead of telling him exactly what I would do, I was fully aware that this would be a learning opportunity for him – one where he would take the information he was provided, make his own decision, and learn from the outcome.

After briefly explaining the ins and outs of the stock market and touching on the exchange of short-term hardship for a long-term reward, I told him the decision was ultimately his call. Afterall, I wasn’t totally sure I wanted him to buy a car anyway because that would mean accepting that my son is no longer a child (kidding!).

In the end, Caleb made the decision to continue investing in mutual funds, sacrificing a potential quick return and a lot of Hot Wheels negotiations for a plan designed for a longer-term reward and human-sized Jeep negotiations.

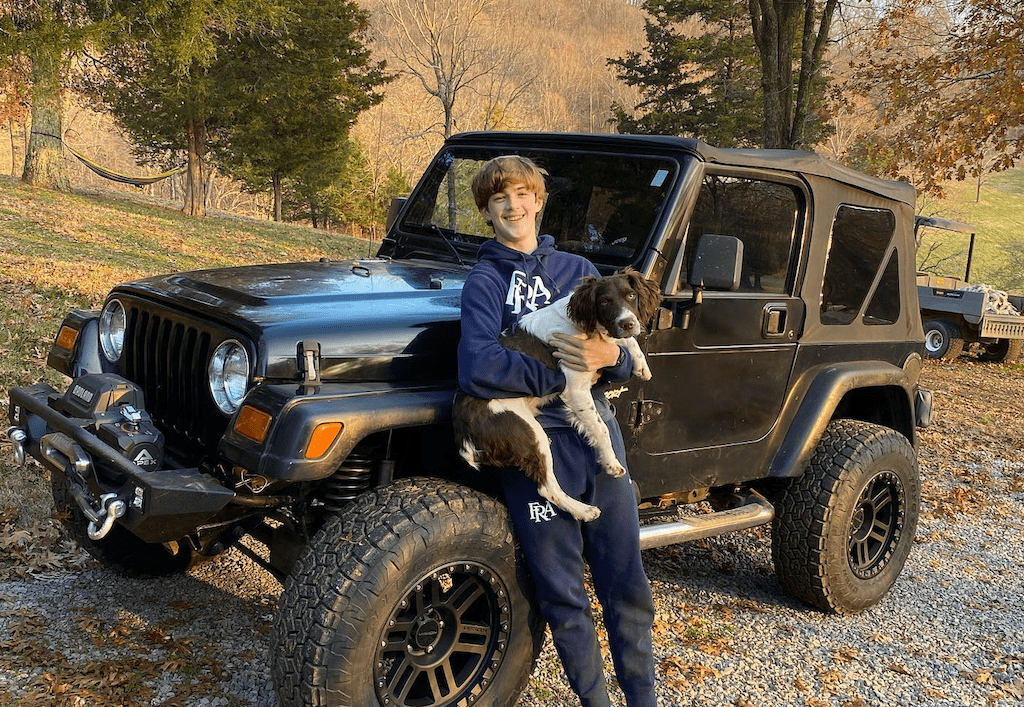

By age 15, Caleb bought his first car with his own money. On top of saving, he did all the research, handled the negotiations, got the seller to lower his price, and walked away so that he could sleep on it before making the purchase.

Today, on his 16th birthday, Caleb has his own Hot Wheels and the freedom that comes with this milestone (with some parameters from his parents, of course).

Nick Murray, who some of you may follow, is a financial advisory professional of 50+ years, one of the industry’s premier speakers, and the author of twelve books for financial services professionals. As I write this, I think of him and his three cardinal virtues of investing: Faith, Patience, and Discipline. Without directly stating what these mean when it comes to investing, my son demonstrated an innate understanding of at least two of these three virtues – Patience and Discipline – as a 16-year-old.

Proud is an understatement.