As the legendary investor Peter Lynch once said, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

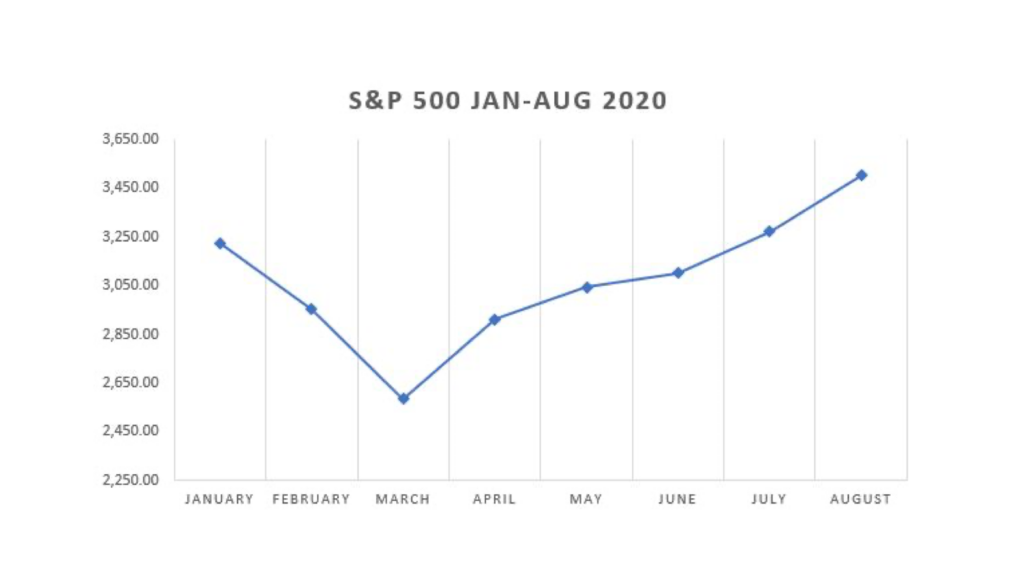

The stock market, as measured by the S&P 500, fully recovered from its volatility and reached a new all-time high on Tuesday, August 18th. When the market plunged by approximately one-third back in late March of this year, did you hear anyone saying it would take less than 5 months to fully recover? Market downturns are almost always less severe and shorter in duration than most would project. However, even after this amazing recovery, most investors still have one of two contrasting views on the market. Some believe this market is “over-priced” and see no justification for staying invested. They can’t stand the volatility and somehow believe they won’t be rewarded for taking prudent risks. Others believe this market is resilient and are happy they never got out. They understand that diversified investors have always been rewarded handsomely for taking measured risk in a portfolio. Therefore, they understand there is no need to try and avoid the perceived problem of volatility.

Which group are you in? History encourages you to see it one way but never the other. We are all entitled to our own opinions but not our own facts. I’ll leave you with one more quote and let you come to your own conclusions on the matter. If there’s anything we can do to help, we’re only a phone call away. Contact the Purifoy Wealth Team today!

“The four most dangerous words in investing are: this time it’s different.” -Sir John Templeton

*This article was written by Michael J. Purifoy, CPA, CFP®, Executive Vice President, Southwestern Investment Group and Wealth Advisor, RJFS