You may be just starting out in your professional life, with retirement far out on the horizon. Or perhaps you have an established career, and, while you aren’t ready to contemplate retirement just yet, you want to make sure you’re financially prepared when the day comes. Regardless of age, retirement is a primary objective for most people. It can, however, be overwhelming to know just what to do to achieve your retirement goals. Here are some helpful tips for ways to prepare for retirement.

Start saving now

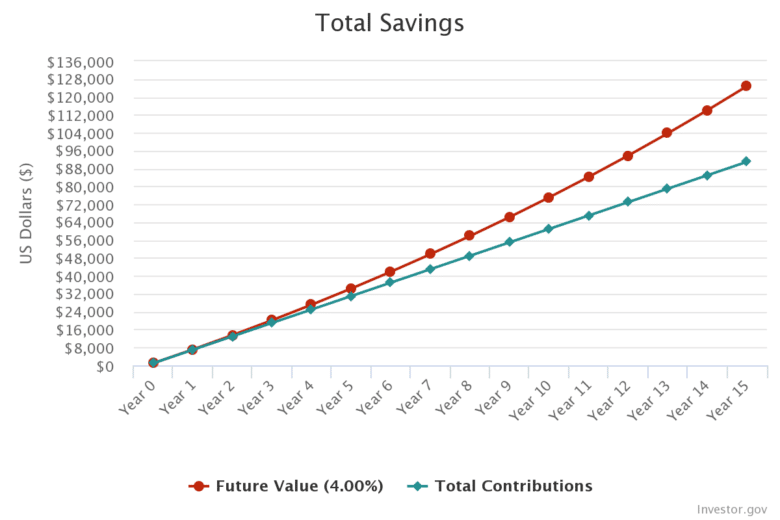

It’s never too early, or too late, to start saving for retirement. In fact, this is a critical step to take to help you benefit from the power of compounding over time. Through compounding, the earnings that your investments generate can be invested to generate additional earnings, and so on. As a result, the longer your money is invested, the greater the likelihood that you will benefit financially in the long-term.

The Power of Compounding Interest

As the table below shows, while it’s always best to start early, the power of compounding can still make a significant difference no matter when you start.

*Assumes a $500 monthly contribution, 4% interest rate, compounded monthly. This is a hypothetical illustration and is not intended to reflect the actual performance of any particular security. Future performance cannot be guaranteed and investment yields will fluctuate with market conditions. Investing involves risk and investors may incur a profit or a loss regardless of strategy selected.

Source: https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

Use tax-advantaged savings opportunities

Tax-advantaged savings is one of the most important tools you can use to help save for retirement. If your employer offers a retirement plan that allows you to contribute on a pre-tax basis, such as a 401K, utilize this pre-tax account style by paying less taxes when contributing to a 401K and help to save for retirement. With these plans, earnings are tax-deferred, so you don’t pay any taxes until you take a distribution, at which time you are likely to be at a lower income tax bracket. And, if your employer matches a percentage of your contribution, this can add to your potential investment amount annually. Many employers now also offer the option of a Roth 401K, which allows you to make after tax contributions and enjoy tax-free withdrawals once you retire (certain limitations may apply), while paying no additional taxes on your investment gains.

If you don’t have a company retirement plan, you may be able to contribute to a traditional or Roth IRA.

If you are not sure what your company offers, your HR or employee benefits department can help you understand your benefits, while your financial advisor can help you determine the most appropriate option for your situation.

Record your progress

Making sure you’re staying on track to achieve your retirement plans will help you see if you need to make any changes to your strategy and stay motivated as you see yourself getting closer to reaching your target. Your financial advisor can help you determine how much you need to save to enjoy retirement, and where you are in terms of getting there.

Evaluate changes in your life or goals

Finally, one thing we have all learned over the past few years is that life can change in an instant! Changes can affect your plan both positively and negatively, and they need to be factored into your plan. Perhaps you’ve received an unexpected inheritance, or you’ve decided to continue working longer than originally planned, enabling you to adjust how much you need to save for retirement and giving you additional funds for everyday living now. Conversely, you may need to provide for family members who are unable to support themselves, even after you’ve retired, so you need to increase your rate of savings.

Consult With Your Advisor

Every person’s retirement journey is unique, and meeting with a financial professional can help determine what’s right for you. If you haven’t already, talk to your advisor at SageSpring Wealth Partners to go over your retirement expectations and aspirations. They can help you put a sound plan in place, so your specific needs can be met. Get started today.